The US stock market is one of the most influential financial institutions in the world. It serves as a barometer of the country’s economic health and a hub for investors looking to maximize their returns. In this article, we will explore the performance of the US stock market, its impact on the economy and society, and the trends that shape its future.

Performance of the US Stock Market

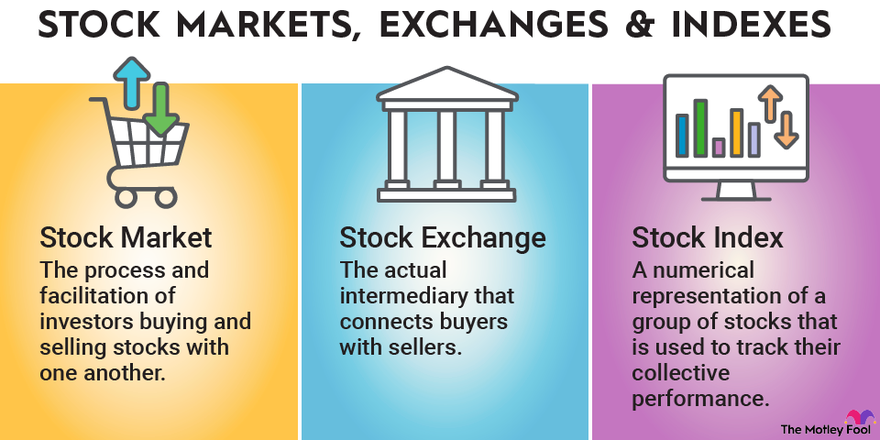

The US stock market is composed of various indices, such as the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite. These indices are used to track the performance of different sectors and companies in the stock market.

Overall, the US stock market has experienced a strong performance over the past decade, despite occasional setbacks. For instance, the S&P 500, which tracks the performance of the largest 500 companies in the US, has shown an average annualized return of 16% over the past ten years. This is significantly higher than the average return of other investment options, such as bonds or savings accounts.

The performance of the US stock market is influenced by various factors, including macroeconomic indicators, geopolitical events, and corporate earnings reports. For example, when the US economy is performing well, with low unemployment rates and strong GDP growth, investors tend to be more bullish on the stock market. On the other hand, when there are concerns about inflation, recession, or political instability, investors tend to be more bearish and cautious.

Impact of the US Stock Market

The US stock market has a significant impact on the economy and society at large. Here are some examples:

- Job Creation: Many companies listed in the stock market create jobs and contribute to economic growth. As a result, a strong stock market can stimulate job creation and boost consumer spending.

- Wealth Creation: The stock market provides investors with an opportunity to generate wealth through capital appreciation and dividend income. This can help individuals and families achieve their financial goals, such as retirement, education, or homeownership.

- Corporate Governance: Companies listed in the stock market are subject to stricter regulations and reporting requirements, which can improve corporate governance and transparency. This can help prevent fraud, misconduct, and conflicts of interest.

- Market Volatility: The stock market can be volatile and unpredictable, which can cause anxiety and stress for investors. Moreover, market crashes or corrections can have a negative impact on the economy and society, leading to job losses, bankruptcies, and social unrest.

Trends in the US Stock Market

The US stock market is constantly evolving, driven by new technologies, consumer preferences, and regulatory changes. Here are some of the trends that are shaping its future:

- Technology Disruption: The rise of new technologies, such as artificial intelligence, blockchain, and the Internet of Things, is transforming the way companies operate and create value. This is reflected in the increasing dominance of tech companies in the stock market, such as Apple, Amazon, Microsoft, and Google.

- Environmental, Social, and Governance (ESG) Investing: Investors are increasingly concerned about the social and environmental impact of their investments. As a result, there is a growing demand for companies that prioritize ESG factors, such as sustainability, diversity, and ethical practices. This trend is reflected in the rise of ESG-focused funds and indices, such as the MSCI World ESG Leaders Index.

Retail Trading: The democratization of investing has enabled more individuals to participate in the stock market, thanks to online platforms and commission-free trading. This has led to a surge in retail trading, particularly among younger generations who are more comfortable with technology and social media. This trend is reflected in the popularity of platforms such as Robinhood, Coinbase, and Square.